This article shall briefly explain the current climate in the European Union (“EU”) and apposite European Economic Community (“Community”) with regard to dumping legislation, inclusive of contemporary decisions which have attempted to address how intra-Community markets should indemnify EU industry from, inter alia, mass imports from foreign enterprise which could adversely affect Community industries.

Like most state systems, the EU region has developed measures for counteracting excessive intrusion from third-party providers/sellers that would have a significant effect on its industries. Rules regarding tariff and other measures were passed with respect given to World Trade Organisation (“WTO”) counterparts, most prevalently Article VI of the General Agreement on Tariffs and Trade (“GATT“), which attempts to define the principles and circumstances within which investigations, duties and remuneration for damage to business may be pursued. GATT rules attempt to ensure fair competition between state and third-party actors without unnecessary duties; the EU incorporated WTO articles to require investigations into anti-dumping be applied only as a matter of last resort, and when [EU] regional industry was suffering particular disadvantage via the predatory pricing of third-party goods, this in respect of pricing in their respective home markets.

What is dumping?

Dumping takes place when a third-party provider (in this, case a foreign enterprise outside the EU) sets the price of product for export at below the value of the product on its domestic market, thus giving the export an unfair advantage in its destination market.

World Trade Organization (WTO) law

Under WTO Law, dumping is considered an unfair trade practice which importing countries can counter by introducing an antidumping duty, as long as they prove: (1) the existence of dumping, (2) the existence of serious injury to the domestic industry, and (3) a causal link between dumping and that injury. As the EU is a signatory to GATT, its legislation uses its international treaty mechanisms as a model for its regional anti-dumping instruments.

EU Legislation

Current domestic measures pertaining to anti-dumping legislation can be found under the heading of Council Regulation 2016/1036 (hereafter “the Dumping Regulation”), which also sets out criteria within which anti-dumping duties may be addressed. Under Article I of 2016/1036, Dumping will have to have been shown to exist – i.e. the good in question will be shown to be less than a comparable price for a like product, in the ‘ordinary course of trade’, as established for the exporting country.

As part of GATT, anti-dumping investigations are to end immediately in cases where the authorities determine that the margin of dumping is insignificantly small (defined as less than 2% of the export price of the product); In other words, the price difference of the good in question has to have been shown to be significant enough to warrant anti-dumping measures. EU legislation reiterates that the volume of goods imported cannot be shown to be negligible (de minimis), and further states that the interest of the Community, i.e. the costs of taking measures must not be disproportionate to the benefits.

Finally, the causal link between harm to the industry and the imports in question must be proven to exist, this to satisfy both EU and WTO rules. There are rules governing what form or amount anti-dumping duties can take under the Regulation and WTO.

Current trends

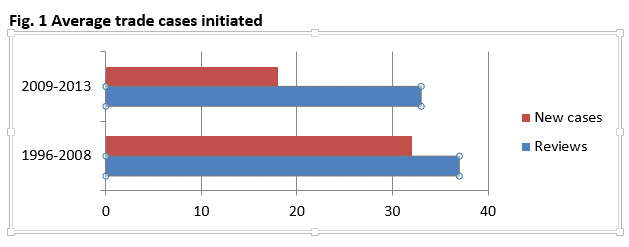

The uptake of the codified Council Regulation 1225/2009 and its amendments on 20 July 2016 was a ‘response to the expiry of parts of China’s WTO accession protocol in December 2016 and to unfair trade practices from third countries’ (http://www.europarl.europa.eu/RegData/etudes/BRIE/2017/595905/EPRS_BRI%282017%29595905_EN.pdf). While the EU has sought to establish a market that allows free competition between all enterprises within a given industry, the obvious complexity of international trade – particularly in light of the malleability of markets in various sectors (e.g. the availability of low-prices imports of high-tech and textile goods) sometimes requires the market to be regulated via the mechanism of imposed duties to exporting agencies abroad, which is accepted as part of GATT’s article VI. This being said, anti-dumping, and trade defence cases in general have seen a significant decline, with average initiations of actions currently at an historical low. Moreover, the overall number of anti-dumping and anti-subsidy measures in force in the EU have been progressively less than in other major WTO members (http://ec.europa.eu/trade/policy/accessing-markets/trade-defence/actions-against-imports-into-the-eu/index_en.htm).

The EU therefore can be seen to apply certain mechanisms of the anti-dumping regime rather stringently – particularly as the EU moves more towards the imposition of duties rather than requesting the exporter to raise their price to avoid the imposition of duties. Arguably, this shift could be seen to have manifested trade conflicts with third-party producers in certain industries.

Latest reforms

The EU has been under increased pressure to reform anti-dumping investigate procedures and decision-making, particularly in light of imposed extra duties on Chinese and Tawainese imports of certain types of steel. In Mid-May 2017, the EU taxed Chinese imports with an added duty, this ranging from 29.2 percent to 54.9 percent, which has foreseeably resulted in complaints. This decision can be seen to be in line with various other applications of anti-dumping trade defence from the European standpoint, with the WTO upholding an Argentina complaint with regard to biodiesel exports, this in conjunction with a similar Indonesian filing.

Further, on 9 June 2016, the Court of Justice of the European Union ruled that the European Commission (EC) violated its own laws by issuing a country-wide anti-dumping (AD) duty on imports of U.S. ethanol (https://www.fas.usda.gov/data/eu-28-eu-s-general-court-rules-against-anti-dumping-duty-us-ethanol).

The European Union, in an attempt to avoid treating any industry or third-party producer as a special case, has reiterated its explanation that it will use international benchmark pricing to determine production cost of industry, this to assess whether manufacturers are dumping product or benefitting from unfair subsidies. However, these recent events have put the EU’s trade defence rules under pressure, and may cause changes to those rules in the near EC mid-term, including discussions of what is likely to happen during the ongoing dispute before the WTO’s Dispute Settlement Body initiated at China’s request.

Finally, the European Parliament and the Council have agreed to change the EU’s anti-dumping and anti-subsidy legislation. One of the main changes was the introduction of a new way to calculate dumping in anti-dumping investigations on imports from members of the WTO, in case prices and costs are distorted because of state intervention (http://europa.eu/rapid/press-release_MEMO-17-3703_en.htm).

The new rules have entered into force on 12 December 2017, date of the publication of the new regulation (http://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:32017R2321).